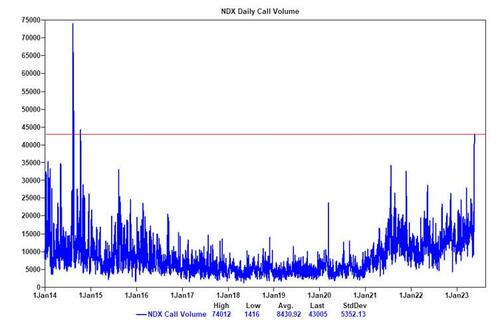

Yesterday, when explaining the real reason for Thursday's tech-led meltup - which

for those who missed it was the biggest call buying spree-cum-gamma squeeze

since 2014...

... we mocked those idiots who blindly parroted the ridiculous narrative that debt

ceiling talks were "going well" (once again for the very cheap seats: "We Won't

See A Debt Ceiling Solution Until The Market Panics") for the simple reason that,

as we went on to say, there would be NO DEAL until the market freaked out, to wit:

But before someone idiotically tosses that today's meltup was because of more

good news on the debt ceiling negotiations (there was zero news, neither good nor

bad, and we hate to break it to you but there will be no debt ceiling deal until after

the market freaks out, so enjoy the frenzied rush higher), the primary explanation for

today's move was simple: the biggest nasdaq gamma squeeze since 2014!

Well, today the idiocy continued and there were those who once again blindly

parroted the narrative that debt ceiling talks are going great and debt deal optimism

is pushing stonks higher.

Just one problem...

... it was - as we warned repeatedly - all a lie, and moments ago Bloomberg

reported what we all know would come out sooner or later (it ended up being

sooner), that the talks have pretty much collapsed after House Speaker

Kevin McCarthy’s top debt-ceiling negotiators "abruptly left a closed-door

meeting with White House representatives soon after it began Friday morning,

throwing the status of talks to avoid a US default into doubt."

“Look, they’re just unreasonable,” Republican Representative Garret Graves said,

adding that the talks were on a “pause.” He added that he did not know if the

negotiators would meet again Friday or over the weekend, which is a problem

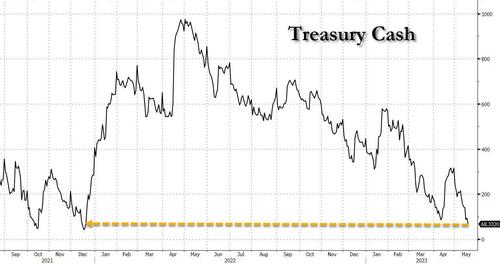

because as we showed last night, the Treasury cash is now down to just $18 billion

away from the Treasury's critical cash level of $50BN, and at this rate, the Treasury

will run out of cash in a few days.

“Unless they are willing to have reasonable conversations about how you can

actually move forward and do the right thing, we’re not going to sit here and

talk to ourselves,” Graves said, as House Financial Services Committee

Chairman Patrick McHenry stood near him.

Graves’ comments come one day after McCarthy said he could see a deal

coming together with a House vote next week (narrator: he was only jawboning

for political purposes; there will be no deal next week). And yet, the 19 year old

woke portfolio managers took McCarthy’s comments as his most positive yet

on the negotiations to avoid a default, and bid risk up like the useful little

liquidity providing idiots they are.

reported what we all know would come out sooner or later (it ended up being

sooner), that the talks have pretty much collapsed after House Speaker

Kevin McCarthy’s top debt-ceiling negotiators "abruptly left a closed-door

meeting with White House representatives soon after it began Friday morning,

throwing the status of talks to avoid a US default into doubt."

“Look, they’re just unreasonable,” Republican Representative Garret Graves said,

adding that the talks were on a “pause.” He added that he did not know if the

negotiators would meet again Friday or over the weekend, which is a problem

because as we showed last night, the Treasury cash is now down to just $18 billion

away from the Treasury's critical cash level of $50BN, and at this rate, the Treasury

will run out of cash in a few days.

“Unless they are willing to have reasonable conversations about how you can

actually move forward and do the right thing, we’re not going to sit here and

talk to ourselves,” Graves said, as House Financial Services Committee

Chairman Patrick McHenry stood near him.

Graves’ comments come one day after McCarthy said he could see a deal

coming together with a House vote next week (narrator: he was only jawboning

for political purposes; there will be no deal next week). And yet, the 19 year old

woke portfolio managers took McCarthy’s comments as his most positive yet

on the negotiations to avoid a default, and bid risk up like the useful little

liquidity providing idiots they are.

Fox confirmed BBG's reporting:

Stocks naturally tumbled on the Bloomberg news, with the S&P 500 Index down

0.2% as of 11:30 a.m. in New York. That’s despite Federal Reserve Chair Jerome

Powell having said, at a separate event, that the central bank might not need to

raise interest rates as high —thanks to potential credit tightening after recent

issues in the banking sector.

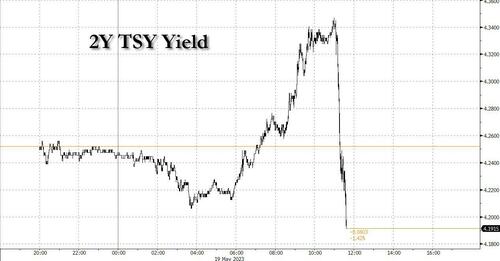

Elsewhere, 2Y yields plunged, reversing all of the days move and then some...

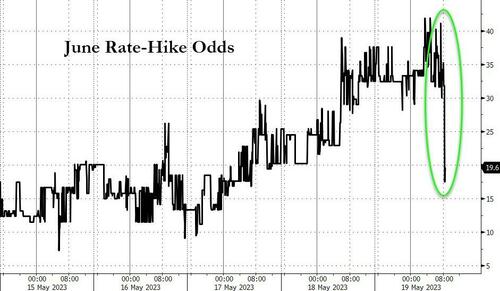

... as June rate hike odds were monkeyhammered...

... while gold - which for some bizarre reason had been sold on

"DeBT tALkS OptiMiSM" - soared.

https://www.zerohedge.com/markets/theyre-just-unreasonable-debt-ceiling-talks-collapse-republicans-abruptly-walk-out